Technology reporters

Getty Images

Getty ImagesUS President Donald Trump has said he plans to introduce 100% tariffs on semiconductor imports.

The tiny chips power a range of different devices and are integral to modern technology and the global economy.

While some semiconductor producers could be spared from the taxes, they may still impact the tech industry and could push up the price of some products.

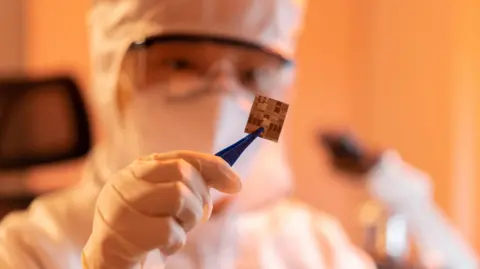

What is a semiconductor and how are they used?

Semiconductors have enabled a slew of modern devices – from smartphones and laptops to video game consoles, pacemakers and solar panels.

Sometimes referred to as microchips or integrated circuits, they are made from tiny fragments of raw materials, such as silicon.

Semiconductors, as the name suggests, can partially conduct electricity – alternating between doing so and acting as an insulator.

This allows them to be used as electronic switches, speaking the binary language of 0s and 1s that underpins computing.

Getty Images

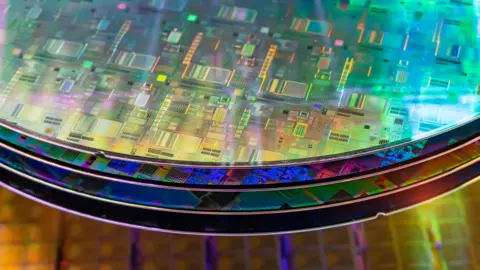

Getty ImagesWhich countries make semiconductors?

The UK, US, Europe and China rely heavily on Taiwan for semiconductors.

The country’s Taiwan Semiconductor Manufacturing Company (TSMC) provides over half of the world’s supply.

Founded in 1987 as the world’s first foundry – dedicated to producing semiconductors for device manufacturers – TSMC now makes them for tech giants like Nvidia, Apple and Microsoft.

It has also been caught up in so-called “chip wars” between the US and China. Each country has tried to slow or cut off the other’s access to essential components, materials and parts of supply chains as they race to develop the best tech.

Samsung Electronics in South Korea is the next biggest supplier.

Together with SK Hynix, it has established the country as one of the world’s biggest semiconductor hubs – particularly for the supply of memory chips.

Why does Trump want 100% tariffs on semiconductors?

One of the main aims of President Trump’s “reciprocal” tariffs during his second term has been to encourage firms to manufacture more products in the US.

In April, the White House exempted smartphones, computers and some other electronic devices from tariffs, including 125% levies imposed on Chinese imports. The tech industry breathed a sigh of relief.

But in early August, Trump reiterated plans to impose tariffs on foreign semiconductors – saying he would introduce a 100% tax on chips from abroad.

He did not offer more details on the tariffs, but said companies could avoid them by investing in the US.

The country is already home to some companies that design, manufacture and sell processing chips, such as Intel and Texas Instruments.

But it wants to be home to more manufacturers, particularly those making the most advanced and in-demand products – many of which are based in Asia.

The President and members of his administration have also cited national security concerns about microchips being produced or sourced from elsewhere.

Reuters

ReutersWhat impact could the tariffs have?

In theory, Trump’s threat to impose 100% tariffs on foreign-made chip imports would impact a wide range of chipmakers and the tech companies who depend on them for semiconductors – given most are based outside the US.

The effect of this could be seen in the form of delays, as companies rush to shift manufacturing to the US, or price rises for some electronics – if manufacturers look to pass the cost of tariffs on to consumers.

But Trump’s caveat that companies committing to manufacturing in the US would not face the levy means the largest semiconductor firms may avoid Trump’s tariffs.

The president said Apple, which sources its semiconductors from TSMC, will evade the 100% tariffs following its further $100bn investment in US manufacturing.

This prompted a 5% rise in TSMC’s share price on Thursday.

Meanwhile South Korean officials have said Samsung and SK Hynix will not face 100% tariffs due to their investment in new US chip fabrication plants.

How could the US make more semiconductors?

The US has spent colossal sums of money in recent years to try and boost domestic technology manufacturing.

Some semiconductor companies, such as TSMC, have already boosted their US presence in response to legislation under the previous administration.

The US Chips Act incentivised firms to move chips manufacturing in the US in return for funding awards.

The US government committed $6.6bn (£5bn) in awards to TSMC after it built a factory in Arizona.

Bloomberg via Getty Images

Bloomberg via Getty ImagesBut production at the site has previously faced delays due to a shortage of skilled workers – something that may present a wider challenge to increasing US-based semiconductor manufacturing.

TSMC reportedly only resolved its staff shortage by bringing thousands of workers over from Taiwan.