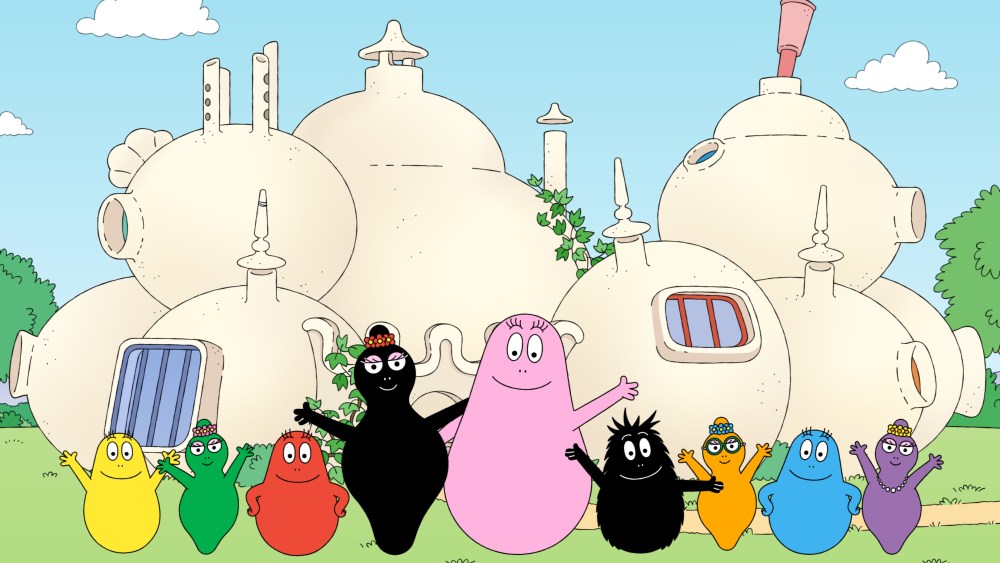

The Unifrance Rendez-Vous TV market in Le Havre came to a close on Thursday with a celebration of animation, namely the latest season and 55th anniversary of the beloved classic series “Barbapapa: One Big Happy Family.”

While animation has traditionally been one of France’s biggest exports, international sales continue to wane for local toon shows – one of the symptoms perhaps of a fast-changing global market whose reverberations are being felt in Normandy.

As Unifrance President Gilles Pélisson explained to Variety ahead of this year’s event, “independent production and distribution face increasing pressure as they compete with streamers and consolidated media groups.” In addition, “broadcasters face mounting challenges and platforms must adapt. We are witnessing an overall slowdown in market attendance, fueled by today’s uncertain geopolitical context.”

Speaking at the Rendez-Vous, Gaëtan Bruel, president of French national film center CNC, added: “We know we are navigating through a challenging period. The contraction of the international market, the changing consumption patterns, the transformation of economic models, and the deployment of new artificial intelligence tools, all of this is reshaping deeply the industry worldwide.”

He nevertheless offered an upbeat assessment of local productions: “French TV series continue to captivate audiences around the world, from the adaptation of the cult manga ‘Cat’s Eyes’that won the Unifrance TV export award last year,to the political drama ‘The Trigger’ – not to mention strong IPs with big success registered by light crime series like ‘Astrid & Raphaëlle,’ a huge asset in today’s uncertain environment.”

Bruel stressed that documentary programs also drive international sales, and, “despite the international crisis affecting the animation industry, France continues to shine with strong IPs such as ‘Mystery Lane,’ ‘Molang,’ or ‘Miraculous: Tales of Ladybug & Cat Noir.’”

This year’s major takeaways at the Rendez-Vous:

Drama Up, Animation, U.S. Tumble Says Export Report

Hard facts and figures on 2024 French TV export announced Tuesday Sept. 6 by the CNC and Unifrance confirmed market trends. On the sunny-side, overall exports at €209.6 million ($244.2 million) were up 3% from 2023, marking the second-highest level in 30 years fueled by co-productions (up 58% year on year at $135.3 million), especially with Europe. Drama confirmed its best-seller status (35.9% of sales).

On the downside animation — although weighing in as the second biggest export category — dropped for the fifth consecutive year, hit mostly by a sharp downturn in U.S. buys, pubcasters’ cuts both in youth programs and specialized staff in kids and youth, and streamers’ turning away from the medium in favor of entertainment and sports.

Across all program types, the report highlighted the need for strong IP to drive sales in a risk-averse environment. Region-wise, Western Europe still dominated (43.2% of revenues), but sales to North America tumbled to its lowest level ever at 7.9% of total export revenues.

Safe Fiction Bets — Thrills and Light Bites

French crime — across various shades of noir — led the drama offer, catering to the international buyers who flocked earlier for Studio TF1’s “HIP,” Mediawan’s “Tom & Lola” or France TV Distribution’s “Astrid et Raphaëlle.”

Among new crime shows, France TV’s Corsican thriller “Vendetta” had a splashy gala launch on Tuesday, attended by the main cast and crew led by creator Ange Basterga and co-stars Thierry Neuvic and Vahina Giocante, while Mediawan Rights bowed Louis Aubert and Matthieu Bernard’s eco-thriller “After Us” in the same Cinéma Pathé Docks Vauban. Federation International had a full slate of new crime titles ranging from “Skin Deep,” set in the world of plastic surgery, to the procedurals “Vigilantes,” “A Case for Kin,” “River Patrol” and the hit multi-season lighter “Deadly Tropics,” back for a seventh run.

Federation’s lineup wasn’t just crime and dark drama – it was already promoting its first ever Christmas comedy, “My Hubert’s Christmas.” Wild Bunch TV, which had a red-carpet launch of its raunchy Prime Video soap “Escort Boys” Season 2, was also in a Christmassy mood with its new offer, “Single Bells.” “It’s light, funny and has a great adaptation potential,” said Diana Bartha, the banner’s head of acquisitions and international sales.

“There is an appetite for solid crime and high-end series, at the same time, bold foreign-language dramas continue to travel well when the stand out in an oversaturated market,” noted Julie Mateille of About Premium Content, which balances English-language drama with well-crafted foreign-language fare.

Strategic Pre-Mipcom Showcase

Unfolding just over a month ahead of Mipcom, Unifrance’s Rendez-vous proved yet again its importance for French sellers and producers as a unique market fully dedicated to French audiovisual works.

Federation International’s co-head of distribution, Guillaume Pommier, underlined Le Havre’s strategic value: “Le Havre is a privileged moment to connect with our partners in a more informal setting, sharing meals, attending events together, which creates a different kind of bond. And as the market is strategically placed ahead of Mipcom, it allows us to present our lineup, get first feedback on certain titles, and fine-tune our strategy before Cannes.

“Also, this year, we took the opportunity to do a screening event for ‘Nature: The Call for Reconciliation,’ the latest event documentary from filmmaker and environmental activist Yann Arthus-Bertrand.”

Safaa Benazzouz, executive VP, Distribution at Xilam Animation, added: “It’s become a tradition at Xilam to attend Unifrance Rendez-vous as a great way to kick off our market season, and the event offers us an ideal opportunity to meet with both new and existing partners.”

Europe Eager to Harmonize Audience Measurement

Discussing the need and progress of establishing greater standardization in audience measurements, Yannick Carriou, head of research company Médiamétrie, stressed the pivotal effect of the rise of ad-supported services (AVOD) among major streamers that has forced them to be more cooperative in audience measurement: “Advertising agencies and brands have literally eased discussions [with streamers]. They told the likes of Netflix, Paramount, HBO Max-Disney: if you’re using ad-supported content, go and see Mediamétrie, because we believe in the reliability and transparency of their figures.”

Carriou stressed: “Streamers have to be accountable to brands, and this has enticed them to change their attitude towards audience measurement.”

Regarding the U.S. audience measurement market and main player Nielsen, Carriou underscored that Nielsen was not self-regulated, but owned by an investment fund, unlike Mediamétrie, a GIE, or economic interest group made up of private and public actors.

“The U.S. market– dominated by streamers – is rather intricate and murky,” Carriou noted.

Commenting on the implementation of the E.U.’s European Media Freedom Act (EMFA), he noted that it was intended “to strengthen freedom of expression and media pluralism, trying to impose through a legal framework the superiority of the self-regulatory model versus streamers’ authoritarian model of data ownership and analysis without external intervention. Streamers are not very pleased, but we are slowly making progress and obtaining better cooperation from their part.”

Streamer Consolidation Squeezing Markets

Discussing the impact of growing concentration in the market, Julia Schulte, SVP International Sales at France TV Distribution, said: “I think we are now feeling the consequences of what it really means to have such worldwide consolidation of the big streamers. In the long-term, it’s all about getting the best out of the whole markets, but investing maybe less. We still work a lot with the streamers, but it’s becoming more local, focused on French territories.”

Producer Iris Bucher, CEO of Quad Drama, maker of the hit thriller “Surface,” said producing “has become more difficult nowadays than, for example, five years ago,” when U.S. platforms were actively chasing subscribers. “Money has become more difficult to get. People are probably more into saving and anxious about the future,” she said, noting the threats by U.S. President Trump to impose tariffs on European movies and TV series. “For the time being, we don’t have that problem, but perhaps one day we will. So it would be even more difficult to sell French shows all over the world.”

The Deals

Brad Pitt’s L.A.-based Plan B Entertainment, part of Mediawan, is opening an office in London headed by producer Ed Macdonald (“Baby Reindeer”), proving yet again France’s pulling power as a leading financial and creative platform for audiovisual works, despite already heavy market build among major indie players.

Oble closed the Albert Camus-adaptation “The Plague” with TV5 Monde, Walter Presents for the U.S. (PBS Masterpiece Prime Video) and RTP for Portugal, adding to multi-deals inked earlier with the likes of AMC Networks International Southern Europe. The show, directed by “Call My Agent!” helmer Antoine Garceau premiered on France Télévisions to strong ratings. The French comedy-drama “Extra,” which screened in competition at Series Mania 2024 ahead of its local premiere on OCS, was swooped on by RTP and Swiss pubcaster RTS. In a separate deal, the lavish period drama “Winter Palace,” the first co-production between Netflix, RTS and Oble, also went to Walter Presents in the U.S., RTP in Portugal and SBS in Australia.

Federation International sold the Yann Arthus-Bertrand event documentary “Nature — The Call for Reconciliation” to Cescka TV for the Czech Republic and ZDF for Germany ahead of its screening in Le Havre. The call to individual action on climate change first aired on France’s M6 in February.

Xilam Animation added several European pubcasters to the BBC, France Télévisions and ZDF-commissioned preschool show “Piggy Builders.” New heavyweight buyers on board include Warner Bros. Discovery in Italy, SVT in Sweden, Yle in Finland, VRT Ketnet in Flemish Belgium, Téléquebec in French Canada and RTS in Switzerland.

France Telévisions picked up Alain Moreau’s historical drama “Unchained,” produced by Tetra Media Fiction. Set in 1806 in Réunion Island, the show, which delves into France’s colonial past, stars Cannes winner Olivier Gourmet (“Le Fils”) and rising talent Enzo Rose.

France TV Distribution also added Marine Gacem’s sexual assault drama “When the Night Comes,” produced by top banner Elephant Story. The thriller, inspired by true events, was produced for France 2.

About Premium Content, sales arm of global boutique group APC Studios, boarded the crime drama-family saga “Blue Gold,” produced by Authentic Prod for France Télévisions. “The Amateur’s” Barbara Probst headlines the soapy drama, in which a curse tied to water runs as a thread across two timelines — the 1980s and contemporary Provence.

Java Films debuted in Le Havre the premium doc “Franco: Spain’s Scorned Memory” helmer Gaëlle Pialot’s exploration of the former authoritarian figure’s legacy in Spain, 50 years after his death. The film produced by Galaxie Presse, is due to premiere in France on Histoire TV this fall.

Kids specialist Madgic Distribution sold “Jade Armor” Season 2 to RTBF Belgium, Telequebec in Canada, Narrative in the U.K.; Hong-Kong-based PCCW bought a package, including “Nitso and the Very Hairy Alphabet,” “Lana Longbead,” “Isadora Moon” and “Jade Armor” Season 2. Elsehwere, TVO Canada and ABC Australia bought “Isadora Moon” and CBBC’s “High Hoops.”

Miam! Distribution picked up the stop-motion/live action “Trash!,” a 50-minute inventive eco-friendly comedy for young adults produced by Darjeeling for Arte France.